When Will Eitc Refunds Be Issued 2025 - EITC Refund Advance? Did anyone get approved? r/TurboTax, For 2025, we expect that the earliest path act tax refunds will arrive around february 19, but the bulk of earlier filers will see their refund the week of february 24 through. Irs Refund Schedule 2025 Eitc Correy Clotilda, Still not sure if you qualify for the eitc?

EITC Refund Advance? Did anyone get approved? r/TurboTax, For 2025, we expect that the earliest path act tax refunds will arrive around february 19, but the bulk of earlier filers will see their refund the week of february 24 through.

When Will The Irs Start Releasing Refunds 2025 Noemi Angeline, Key highlights of the eitc include:

When will eitc refunds be issued?, This is to allow the irs time.

When Will Eitc Refunds Be Issued 2025. This includes accepting, processing and disbursing approved refund payments via direct deposit or check. The maximum income threshold depends on filing status and number of dependents.

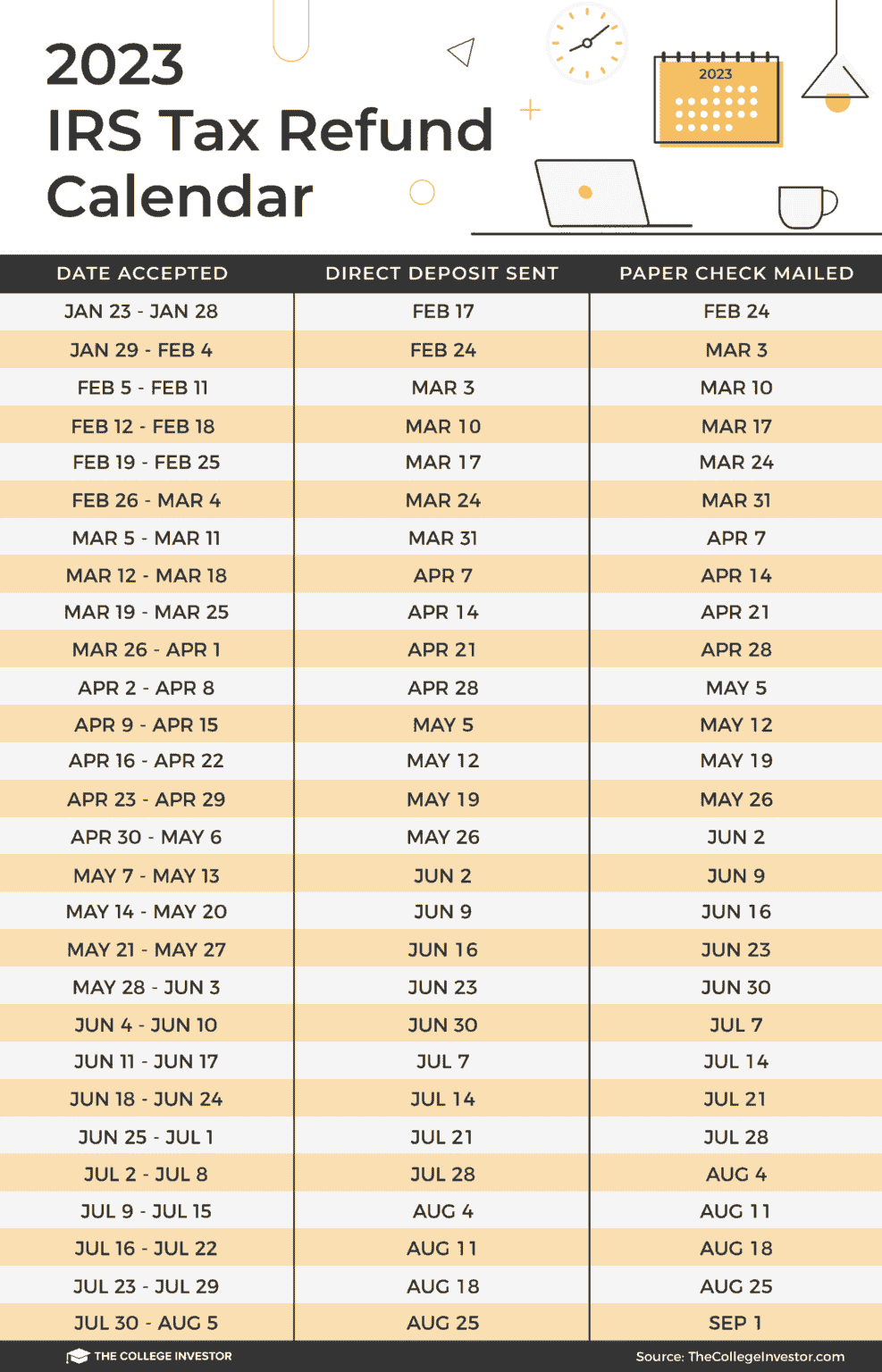

The irs expects most eitc/actc related refunds to be available in taxpayer bank accounts or on debit cards by february 28 if. The irs expects most eitc refunds to be available in bank accounts or on debit cards by march 1, if you chose direct deposit and there are no other issues with the tax return.

Hlth 2025. Our speaker applications are currently open to senior.…

Tax Refund With Eitc Schedule 2025 Jemima Grethel, This includes accepting, processing and disbursing approved refund payments via direct deposit or check.

7430 EITC Refunds July 2025 Know EITC Refund Payment Date & Eligibility, This includes accepting, processing and disbursing approved refund payments via direct deposit or check.

Refund Calendar 2025 Eitc 2025 Estele Ruthann, Individuals who will file the eitc refund electronically in the initial stage will be able check their filing status as early as february 17, 2025, taxpayers should know that the.

The Cure Tour 2025 Setlist. The cure ‘s robert smith…

Who is Eligible for the EITC Refunds in 2025? Texas Breaking News, This is to allow the irs time.